The Digital Dollar Project released a whitepaper last month. The Digital Dollar Project (DPP) is a partnership of the Digital Dollar Foundation, a not-for-profit, and Accenture. The DPP team consists of the former chairman of the CFTC, Chris Giancarlo, his brother, entrepreneur Charles Giancarlo, David Treat, who is a senior managing director at Accenture, and Daniel Gorfine, former head of the CFTC Innovation Lab. They are also backed by an advisory board that reads like a who’s who of the innovation experts from many private and public institutions.

This article goes into the details of two important recommendations laid out in the DPP whitepaper and their possible consequences. Recent House Finance Committee hearings expose the views of some of the principal players on retail central bank digital currency (CBDC) in the United States. A session on financial inclusion on June 11, featured not just Chris Giancarlo, but also critics of the two tier system. The second session of June 17 featured the current Fed chairman, Jay Powell, including his views on the infrastructure of the digital dollar, which comes toward the end of the session.

The aim of the DDP is to advocate a central bank digital currency, the digital dollar. The dollar is the world’s premier reserve currency. The dollar’s special status allows many privileges, including demand for the dollar that sustains the borrowing power of the United States government and the use of the dollar for sanctions. In the whitepaper, the DDP says work on the digital dollar needs to start now. The DDP advocates a public discussion of the research to be conducted by private actors to support the government in its efforts to create an important public good. The DPP calls for a public-private collaboration, including the preservation of the current two tier system for the dissemination of a retail digital dollar.

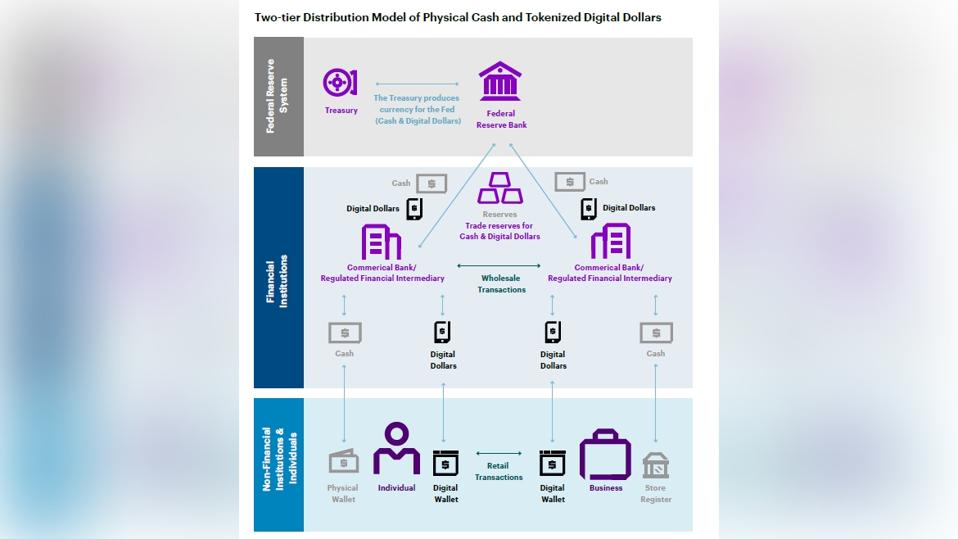

The two tier system of distribution of cash parallel to digital dollars.

The Two-Tier System

The DDP advocates that the digital dollar, just like cash, should be produced by the Fed and distributed by the commercial banks to the general public.

The main benefit of a CBDC like the digital dollar is the fact that it is a liability of the Fed. The Fed is the ultimate counterparty with the lowest credit risk; hence using a CBDC is like using cash or in the wholesale context, a FedAccount using reserves. Paying with retail CBDC is different than paying with a credit card, or check. The check can be stopped or can bounce, payments on a card can be disputed. Paying with retail digital dollars is final and cannot be reversed.

Public Infrastructure

Similar to cash, the Fed would be responsible for the production of CBDC. Production means the technical design, anti-counterfeit measures, and logistics of first tier distribution to commercial banks. This must include further retail distribution as explained below. In case of cash, the constraints around lead times and the flawless creation of a physical artifact needs controlled production and logistics facilities. This is one of the reasons for the setting up of the Bureau of Engraving and Printing under the treasury for minting currency notes. There does not seem to be a compelling reason for the production of CBDC which is a digital artifact, by the treasury as recommended by the whitepaper. Dissimilar to the multi-tier distribution systems for cash, CBDC distribution to commercial banks will be through digital wallets, not involving trucks, multiple federal reserve warehouses, armed guards and elaborate physical protocols. These digital wallets do have to be fraud and counterfeit proof and are an integral part of the infrastructure of CBDC.

It was very evident from Powell’s remarks that the Fed would not be open to private operators creating the digital dollar infrastructure. In the context of a digital good like the digital dollar, the issuing framework, whether backed by DLT or not, as well as the distribution infrastructure through a digital wholesale wallet would be designed and deployed by the Fed. Input from private operators and the public into the process will probably be part of the process. Other than that, it is doubtful whether the Fed will allow direct private sector involvement in the design and build of the digital dollar infrastructure.

More tellingly, the distribution of retail CBDC to the public and businesses through commercial banks and financial operators is also part of the infrastructure of CBDC. In the case of cash, the physical artifact created by the Fed seamlessly crosses the bank-customer boundary. Similarly, a retail digital wallet created and distributed by the Fed will be part of the retail CBDC infrastructure, since that would be the mechanism of crossing the bank-customer boundary. To be effective, it has to support an open infrastructure and be easily integrated into existing commercial wallets.

Digital Identity

Missing from the whitepaper is the concept of digital identity. DDP says this omission is deliberate. Without a firm notion of digital identity and its anonymous expression, a digital wallet functioning in multiple capacities is impossible to construct. In the US, there is a perception that a national identity scheme would be antithetical to privacy and anonymity. This has led to the creation of an ad-hoc system of digital identity patched together from social security numbers, tax id numbers, biometrics, drivers licenses, utility bills, passports, birth certificates. The lack of a national identity also results in a lack of a national privacy law with teeth. This will work out to be one of the greatest challenges for retail CBDC and secure digital wallets.

To remain anonymous one needs a firm notion of correlation and laws to protect against misuse of gathered information. Fourth amendment notwithstanding, the principle of a third-party doctrine is misused during this digital era to gather and sell our everyday interactions. This was also being provided to law enforcement freely before the supreme court’s Carpenter vs. United states ruling that the Fourth Amendment applies in certain contexts even when third parties collect our information.

There are concepts and tools being built in DID and Trust Over IP communities that the federal government as an issuer needs to look at. These concepts are still in the gestational stage, but developments in this area could make a big difference in the creation of a secure digital wallet.

Countries that have created national identity systems, whether it is a small country like Estonia or a large country like India, have seen the rise of standard, regulated national infrastructure that encourages the growth of the private sector in payments and services. This infrastructure also helped these nations leapfrog into virtuous outcomes like increased financial inclusion.

Direct FedAccounts

The proponents of direct FedAccounts challenge a two-tier system. Their contention is that the two tier system has not yielded better financial inclusion. The private sector has created a system where they reap the benefits of the federal infrastructure in good times while passing the risks in bad times on to the central banks and through them to the public. The critics also say that the private sector do not provide services to the poor and disadvantaged and when they do, they gouge them. The DDP argument is that providing account support in the private sector for a retail CBDC will be cheaper because of the use of efficient digital infrastructure.

The fact that the Fed is not setup to be a retail provider of customer facing accounts is countered by the direct FedAccounts adherents. They propose direct retail CBDC accounts for distribution of benefits, setup by the Fed and administered by post offices.

There is nothing that prevents a benefits distribution system with direct FedAccounts coexisting with a two tier system. The private sector would compete based on levels of service, better interest rates, and tighter integration into payment services. A bare bones but secure FedAccount would be on offer for all residents of the US. A future in which cash as well as retail CBDC coexist, along with all the payments rails and infrastructure that exists today. The emergent effects of a retail digital dollar may well change the landscape, that would be sometime in the future.

A Token-Based System

The DDP whitepaper recommends a token-based system for the digital dollar. According to the definition in the DDP paper, a token in such a system would contain all information necessary for the recipient to verify the legitimacy of the transaction. The BoE paper on the promises, challenges and risks of CBDC, and multiple other sources makes it clear that the token as a self-contained message needs some extensions. There has to be a notion of a controlling owner, and the eventual recording of the transfer in a ledger against double spend. Inevitably, the owner and a ledger creep back into the equation. There are designs like the David Chaum’s DigiCash and GNU Taler which do have technical solutions for anonymous peer to peer transfers. Digicash declared bankruptcy, GNU Taler is brand new. Pure peer to peer and customer to merchant could operate in a disconnected setting, but for small amounts.

Cash is the ultimate token. Self contained, it can be used for anonymous peer to peer transfers. The anonymity of cash also makes it a favored vehicle for crime. One is meant to declare cash above a certain amount, as well as control it for distribution to bad actors. In practice it is difficult to implement controls on cash, as cash, which is a bearer instrument can be freely transferred and can be used to evade any know your customer (KYC) rules which directly affect anti-money laundering (AML) and counter terrorist financing (CTF), especially through covert channels like Havala. Cash has many positive qualities due to these same attributes. Cash cannot be censored, it is also the ultimate peer-to-peer transaction method preserving anonymity and freedom.

A retail digital dollar token has the potential to be in much greater demand than cash; maybe even a few orders of magnitude more. People and businesses may not even deposit these, if they have access to a frictionless and secure wallet that can participate freely in the payment systems of today and of the future. This flight from deposits may also happen if the interest rates remain low.

This brings us back to the notion of the digital dollar as a token. For regulatory approval, amounts greater than $10,000 need a full KYC/AML/CTF check. This can only happen from a digital wallet issued to a known, on-boarded customer. The notion that the private sector can help with this customer on-boarding is one of the arguments in favor of a two-tier system.

Since the federal government agencies issue the primary proofing documents, there may be room for an attested digital identity embedded in a digital wallet issued by the feds that can be shared securely for many purposes. Finally liberating the financial institutions from having to do KYC and on boarding repeatedly and handling toxic PII. This may be another result of a comprehensive digital wallet that unifies digital identity with the control of digital cash.

Urgency

The DDP whitepaper argues that if we do not act now, it will be difficult to compete and create an open democratic CBDC infrastructure to vie with the centralized model advocated by the projects supposedly nearing completion now. Most notably the Digital Yuan project. Moreover a survey from the Bank of International Settlement has said that the majority of central banks under its purview are working on a CBDC. The Fed itself does not seem to be in a hurry, mainly due to the enormous loss of trust if the system is hacked. They are understandably cautious.

Let us advocate the creation of a digital dollar in stages. A wholesale CBDC is needed before a retail CBDC, and wholesale transactions must happen before retail can take off. This also sets a controlled proving ground for wallet technology before wide-spread dissemination to retail. In terms of scale, hundred times the total amounts pass through wholesale systems than retail; but among one thousandth the number of accounts.

No Comments

Leave a comment Cancel