Many who are new to crypto assume that there will only be one important cryptoasset in the long run, and that the challenge as an investor is to pick the “best” one.

I disagree.

Why? Because different cryptoassets (and their associated blockchains) are focused on different use cases.

To use an analogy, both Microsoft and Salesforce are software companies, but they are tackling different markets—one winning does not preclude the other from also winning. Similarly, Uber and Instagram are both apps, but again have different features and use cases—and thus both can win.

The same is true in crypto. While various cryptoassets may rely on the same core kernel of blockchain technology, they focus on different use cases, and thus, there can be multiple winners.

The bitcoin blockchain — the blockchain and cryptoasset people usually discover first — is optimized for security and anti-seizure, which makes it perfectly suited to serve as digital gold. Another category of blockchains are focused on being payment vehicles, and thus prioritize features like speed, privacy, or price stability; examples include XRP, USDC, Zcash, and Monero.

Ethereum was the first, and is today the largest, blockchain optimized for programmability (or digital “contracts”). Importantly, this may be one of the most exciting applications of blockchain technology.

Let’s explore.

The Rise Of Programmable Money: One Of Crypto’s Key Fundamental Breakthroughs

“Programmable money” (or assets) is new tech jargon for saying something simple: that cryptoassets can exchange hands in ways that physical assets cannot.

What does that mean? Most people think of a cryptoasset transaction as a simple cashlike way to pay for things; along the lines of “Alice sends cryptoasset X to Bob to pay him.”

With a programmable money blockchain like Ethereum, it becomes easy for a cryptoasset transaction to take on a more complex form; something like, “Alice sends cryptoasset X to Bob, but only after Carol also agrees with this transaction.”

This may sound to you a lot like an escrow transaction, which is regularly used by individuals completing home purchases or by companies executing M&A deals. The difference, and the breakthrough, is that crypto allows you to do this without an escrow company, lawyers, or a bank … and as a result without any of their fees, delays waiting for them to be open and responsive to you, or biases.

The transaction above is just one example. It would also be easy to add another level of complexity, such as, “Alice sends cryptoasset X to Bob, but no sooner than 5 years AND only after Carol agrees to it”—which looks more like a trust—or “Alice sends cryptoasset X to Bob if Carol wins the race, AND Bob sends cryptoasset Y to Alice if Carol does not”—which looks more like a contract.

The ability to execute transactions more complex than a direct payment is what defines the concept of “programmable money.” Many cryptoassets (including bitcoin) can handle the simplest forms of these transactions, but the Ethereum blockchain is designed to support complete customizability and complexity.

In other words, Ethereum’s core value proposition today is to ask the question: What if we could apply the “programmable transactions” capability to rethink virtually every type of service offered by the financial industry, from simple escrow accounts and trust entities to such complex ideas as capital raising, collateralized borrowing, product structuring, lending, margin trading, and more?

What if we could replace huge chunks of the rent-seeking, history-of-bad-behavior, and solvency-risk financial system with something software-based, easy to audit, nonreliant on human judgment, and vastly more efficient?

Ethereum’s Explosive Recent Growth; Stablecoins, Lending Efforts Surge Into The Billions

The crypto community has come up with a term to describe this category: “decentralized finance,” or “DeFi” for short.

The initial reaction most investors have when they hear about “DeFi” is that it sounds nice but also kind-of science-fictiony; real-world applications, people assume, must lie many years in the future.

But while it hasn’t gotten much attention in the popular media, real-world applications of DeFi have been exploding in usage in recent months. In fact, we’ve seen two multibillion-dollar use cases develop in the first half of 2020 alone: one focused around stablecoins and the other anchored on the extremely successful launch of Compound, a decentralized lending market.

1. Stablecoins

Stablecoins are cryptoassets pegged to a fiat currency, most frequently the U.S. dollar. They’re used today primarily to make fiat currencies usable in the crypto world—almost like an ADR makes foreign equities tradable on U.S. markets—and are one of the fastest-growing corners of the crypto marketplace.

Stablecoins fulfill many real-world uses. They are used by crypto investors who want to park money in nonvolatile U.S. dollars without withdrawing money from crypto exchanges; by individuals who want to create digital contracts (as described in the Alice, Bob, etc., examples above) that settle in USD; by individuals in countries with capital controls to store money outside of the local fiat system; and as a wire alternative with no fees and no cutoff times or closed days. More recently, stablecoins have emerged as a base asset for many decentralized finance applications.

How does this relate to Ethereum? Ethereum has established itself as the platform of choice for the issuance of stablecoins, done via the programming of Ethereum’s flexible digital contract capability as described above.

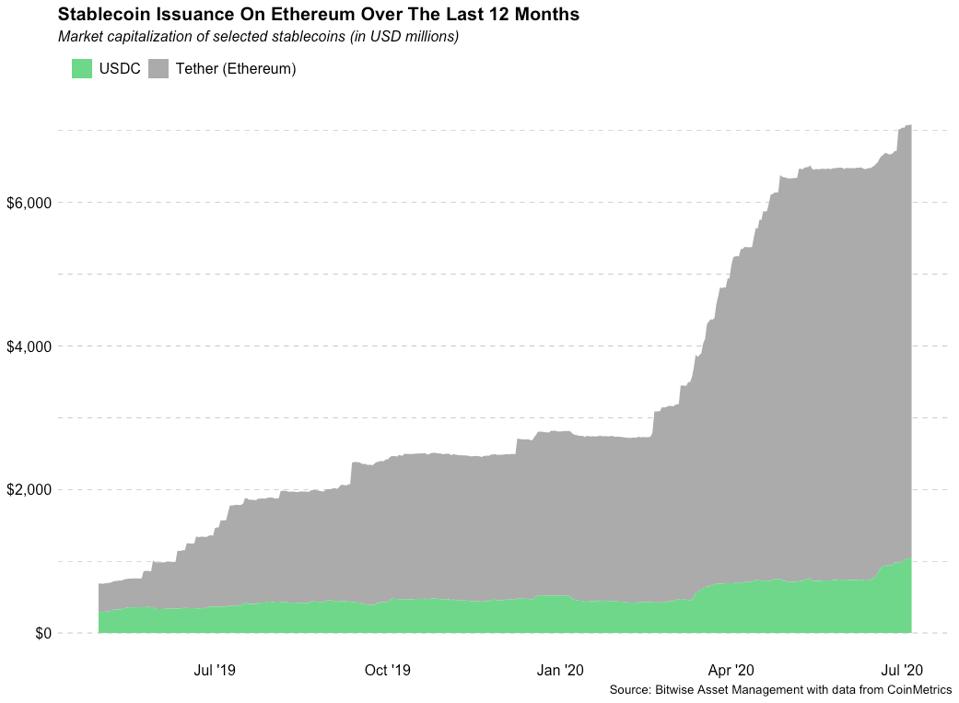

The two most important stablecoins, Tether and USDC, have seen explosive growth in the past year, with total assets outstanding on the Ethereum network rising from less than $1 billion 12 months ago to more than $7 billion today. This growth shows no signs of slowing down.

The Explosive Growth of Stablecoins On Ethereum

2. Lending

Developers have experimented with using Ethereum’s digital contracts to create a market for borrowing and lending other cryptocurrencies, programmatically. One of the most successful recent iterations is Compound. Compound is essentially a decentralized money market for cryptoassets that counts prominent investors like Andreessen Horowitz (a16z) and Bain Capital among its backers.

Compound provides the functionality you might expect from a bank: Savers can deposit cryptoassets and earn interest, while borrowers can access collateralized loans on the platform. As discussed, there are no trusted third parties between the user who lends and the user that borrows; it’s all taken care of by the decentralized software program and its related token.

Launched earlier this year, Compound today has amassed almost $700 million in assets. Competing protocols have also amassed significant assets, as shown in the chart below. In total, these platforms today control more than $2 billion.

While that isn’t “replacing the banking system,” it’s also not trivial for brand new tech, and the growth is explosive; a year ago, this space essentially didn’t exist.

DeFi Assets By Project

How Sustainable Is DeFi And How Much Can It Grow?

One interesting thing about the way the decentralized finance ecosystem has developed is that these programs, which all run on top of the Ethereum network, can be combined in different ways to offer new solutions.

A common analogy is that building in the decentralized finance marketplace is like building a castle out of Lego, where each program (stablecoins, lending, exchanges, etc.) is like a generic Lego block, and can be used together in different combinations to do increasingly complex things.

The more of these Lego pieces, the more combinations of new products are possible, the more utility develops, and the more Ethereum establishes itself as a leader in the space.

As a nascent technological development, decentralized finance of course comes with a fair amount of risk, a limited track record, and difficulty of use. Just like bitcoin is not guaranteed to become digital gold, Ethereum is by no means guaranteed to find a large market for digital financial contracts.

We think, however, that many investors are right to have broad exposure to this opportunity set, as the opportunity is huge … after all, a good investment isn’t about finding that there is no risk, but risks that have commensurate return potential.

In this case, ether’s market cap today is a fraction (around 10%) of just the fines that U.S. banks paid since the 2008 global financial crisis. If Ethereum becomes the base layer for a new and alternative financial services system, the upside is tremendous.

It’s also needed.

Despite all the fintech companies and banking apps that have emerged in the past few decades, much of the financial services community remains notably tech-backward and high-fee. Estimates suggest that 80% of all financial transactions are still processed on COBOL, a programming language developed in 1959 when most programmers still used punch cards.

Perhaps what’s needed for the next wave of innovation isn’t a slick mobile app or back-office machine learning model, but rather a flipping of the model on its head. Getting rid of the middleman—as the breakthrough of blockchain software allows—could remove fees, end delays due to business hours and legacy systems, prevent insolvency by increasing transparency, and allow anyone in the world to create any contract at any size. Those are powerful features; the type that could create disruptive change.

And that’s why we think Ethereum, and the programmable money category in general, is worth paying attention to. It’s also why it’s performed so well in 2020, as the concept begins to gain traction.

[My colleagues David Lawant and Hunter Horsley contributed to this article.]

No Comments

Leave a comment Cancel