Bolton book reveals President Trump’s suspicion of Bitcoin, but his administration’s actions support Bitcoin and Ethereum at the expense of other crypto currencies.

National Security Advisor John R. Bolton, yellow legal pad in hand, listens to President Donald J. … [+]

As reporters and late night talk show hosts rifled through purloined copies of John Bolton’s forthcoming The Room Where it Happened they found backstabbing and betrayal, bombshells and buffoonery. And they found bitcoin.

An anecdote in Bolton’s book reveals that President Trump has a distaste for bitcoin dating back to at least May 2018, when the President chastised Treasury Secretary Steven Mnuchin’s approach to China trade negotiations. As relayed by the Washington Examiner, Bolton took notes as this scene unwound:

“Don’t be a trade negotiator,” Trump allegedly said… “Go after bitcoin [for fraud].”

“If you don’t want me on trade, fine, your economic team will execute whatever you want,” Mnuchin responded in a tense exchange over upcoming trade sanctions and tariffs on China.

Trump seems to know that China controls bitcoin. And Mnuchin doesn’t seem to care. Mnuchin never went after bitcoin. Indeed, Trump’s administration has supported bitcoin and Ethereum — at the expense of American-made crypto currencies. This has happened even as China has tightened its grip on bitcoin and ether mining.

It started back on June 14, 2018, when the SEC’s Director of the Division of Corporation Finance Bill Hinman announced a surprising new policy toward the two crypto securities at a Yahoo! Finance conference in San Francisco. (Hinman went on stage just before me.)

“As with bitcoin, applying the disclosure regime of the federal securities laws to current transactions in ether would seem to add little value,” he said, further arguing that they might have been securities at the start, but had eventually achieved decentralization from any one enterprise.

Like a priest at confession, Hinman was conferring forgiveness and blessing to just two crypto currencies. I stood in the wings with my mouth agape. The guy next to me showed me his Coinbase account: the price of bitcoin and Ether soared.

It seemed more were to come: “Over time, there may be other sufficiently decentralized networks and systems,” he said that Thursday morning, “where regulating the tokens or coins that function on them as securities may not be required.”

The SEC followed up with more institutionalized support for bitcoin and Ethereum on November 16, 2018 with “A Statement on Digital Asset Securities Issuance and Trading.” The statement singled out security enforcement actions involving AirFox, Crypto Asset Management, Paragon, TokenLot, and EtherDelta’s founder Zachary Coburn. It continued to bless bitcoin and Ethereum.

And what of other crypto platforms? Cardano? EOS? Litecoin? XRP? Not a word.

This had the effect of drawing the crypto community into three groups: the bad guys in the penalty box, the good guys (bitcoin and Ethereum) free to go and everybody else in limbo. If you’re a developer, what would you do? Where would you place your bets?

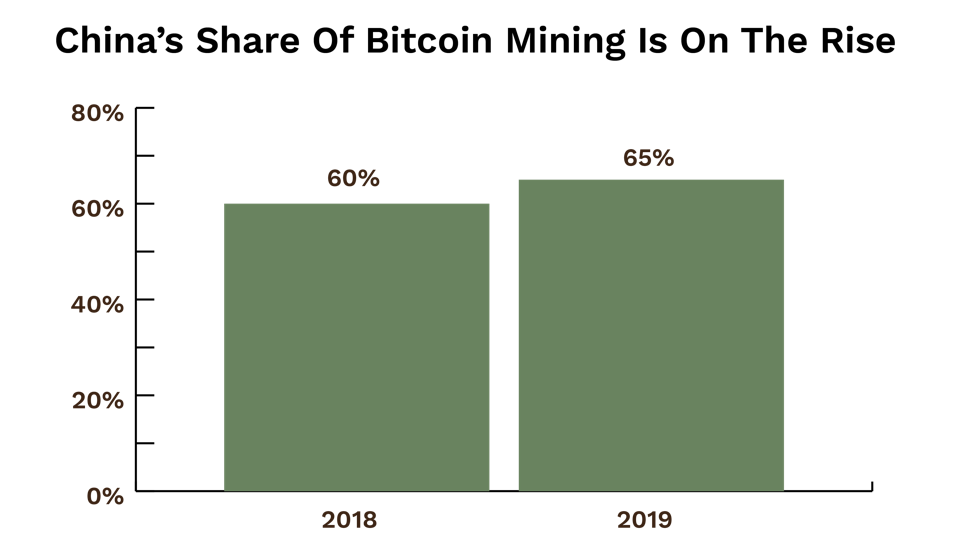

Seeing this, China has doubled down on its support of bitcoin and ether mining on its shores. A December 2019 report from CoinShares research studied changes in bitcoin’s hashrate — essentially a measure of bitcoin mining activity. They found enormous activity in China, more than ever before. While the Chinese government was giving mixed signals about its support of blockchain, it was quietly allowing miners access to some of the cheapest power in the world for the mining of bitcoin and Ether. The result? “As much as 65% of bitcoin hashpower resides within China,” CoinShares said, “the highest we’ve seen since we began our network monitoring in late 2017.”

Source: CoinShares Research

Much of that was in the Sichuan province, with its 90,000 MW of hydroelectric power. “Sichuan alone produces 54% of global hashrate,” said CoinShares, “with the remaining 11% split more or less evenly between Yunnan, Xinjiang and Inner Mongolia.”

At the same time Chinese computer manufacturers were reportedly funnelling the best new chips and hardware to those miners. CoinShares also found that Beijing-based computer maker Bitmain controlled 66% of the global crypto mining business, including high-powered machines introduced in 2018 dedicated to ether mining.

To be sure, the location of Ethereum’s hashrate is not as closely studied, but “mining pool” concentration suggests that Ether, too, is dominated by Chinese miners.

The risk? With control of over 51% of the bitcoin or Ethereum network, China could direct miners to enter malicious blocks onto the chain, ban certain payments, reverse transactions and generally wreak havoc. It’s hypothetical, but China always plays the long game. As Deng Xiaoping said: “Cross the river by feeling every stone.”

“China certainly would like to dethrone the dollar as the world’s reserve currency,” says Gordon Chang, author of The Coming Collapse of China. “Controlling bitcoin would be important. Controlling bitcoin would give China additional leverage over global capital markets. The ultimate goal is to dominate everything.”

The Trump administration, by refusing to provide a clear regulatory framework for any other crypto currency, has given a boost to bitcoin and Ethereum. And now China is within arms reach of controlling both.

It’s fair to say: if the future of money is digital, the Trump administration is ceding the future of money to China.

No Comments

Leave a comment Cancel