null

Since growth stocks are trouncing value stocks these days, maybe the best, most obvious contrarian play would be to identify the cheapest in the value stock universe. Right now, a quick screen reveals that at least 4 insurance firms make the grade as “cheap” in the classic Benjamin Graham sense.

When the Columbia University business professor was writing Security Analysis and The Intelligent Investor —and when Warren Buffett was his student more than 50 or 60 years ago — certain insurance stocks of that era were also considered cheap.

Without delving too deeply into the possible reasons for general investor avoidance of the sector this time around, here are a few names based solely on some of the key “value” metrics used to identify potential candidates.

Aegon

AEG weekly price chart, 6 28 20.

The stock is available for purchase at just 21% of its book value. The price/earnings ratio is an extraordinarily low 3.66. Earnings were excellent last year but the expectation going forward is negative. Meantime, shareholder equity exceeds long-term debt and Aegon continues to pay a 5.78% dividend. The stock is low-priced at $2.87 a share.

The Hartford Financial Services Group is listed on the New York Stock Exchange and based in Connecticut.

The Hartford Insurance Group weekly price chart, 6 28 20.

You can buy shares in this large insurance company at a 10% discount from book. The price/earnings ratio of 7.99 is substantially below the p/e of the S&P 500 index at 22. The Hartford is having a good earnings year and the 5-year track record looks good as well. Long-term debt is less than shareholder equity. The dividend is 3.47%. On June 1st, Bank of America

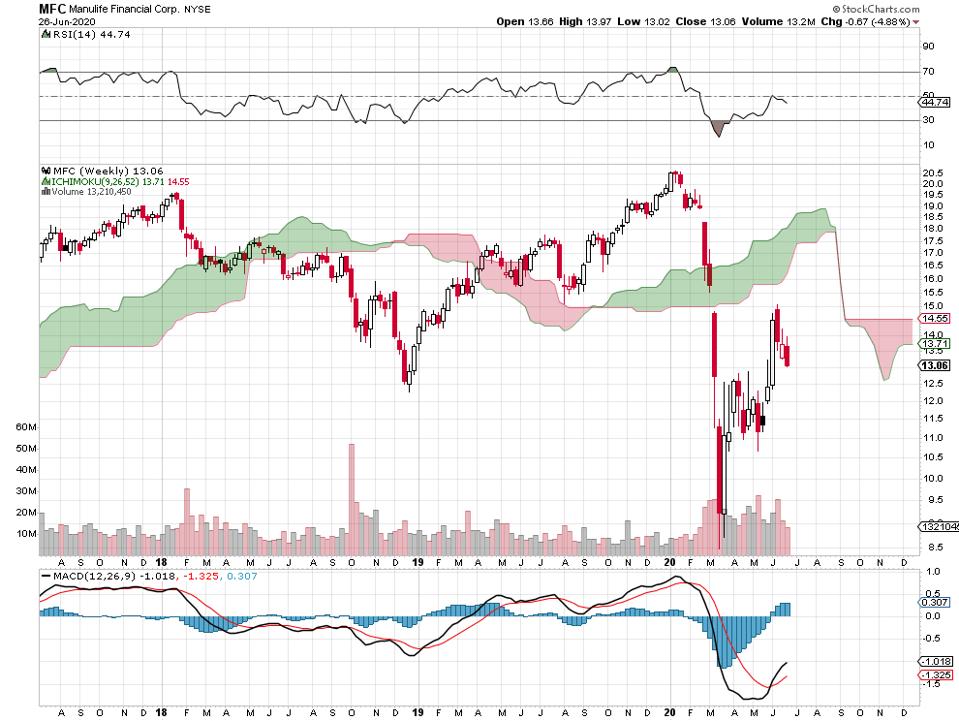

Manulife Financial has headquarters in Toronto, Canada and shares which trade on the New York Stock Exchange.

Manulife Financial weekly price chart, 6 28 20.

The company trades at 61% of its book value and the price/earnings ratio is 7.66. Their earnings per share for this year is quite good. The 5-year record is also positive. Shareholder equity exceeds the amount of long-term debt. Manulife, at this price, pays a dividend of 6.28%. As recently as mid-May, Credit Suisse analysts upgraded the stock from “neutral” to “outperform.”

Reinsurance Group of America

Reinsurance Group of America weekly price chart, 6 28 20.

With a price/earnings ratio of 7.8, the stock is trading at about half of its book value. Earnings this year are very good and they’ve been in the green over the past 5 years. Long-term debt is lower than shareholder equity. RGA investors receive a 3.73% dividend. Average daily volume is somewhat lighter than the other insurance stocks mentioned — coming in at about 862,000.

These are not recommendations to purchase. What is likely and worth considering is that such stocks are likely to be making the lists of large institutional value investors who screen for value. While growth stocks are certainly having their day, this type of thinking definitely requires a confirmed contrarian bent.

To read more about this type of stock screening, please take a look at the Forbes Probabilities blog post Identifying Value Stocks Is Methodology And Art.

Stats courtesy of FinViz.com.

I do not hold positions in these investments. No recommendations are made one way or the other. If you’re an investor, you’d want to look much deeper into each of these situations. You can lose money trading or investing in stocks and other instruments. Always do your own independent research, due diligence and seek professional advice from a licensed investment advisor.

No Comments

Leave a comment Cancel