Bitcoin’s early 2020 rally has come to an abrupt halt, with the price failing to hold above $10,000 per bitcoin.

The bitcoin price, up around 30% so far this year, has been treading water at around $9,400 since it briefly moved above $10,000 earlier this month.

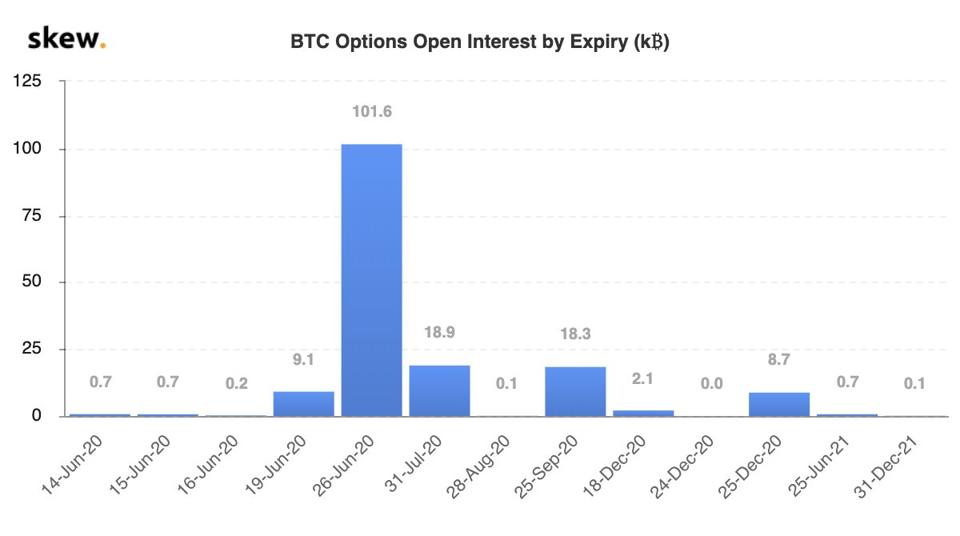

Now, bitcoin traders and investors are braced for more than 100,000 bitcoin options totaling $930 million to expire on June 26—nearly 70% of bitcoin’s entire open interest.

Bitcoin traders and investors are braced for major moves in the bitcoin price this week after a … [+]

Bitcoin’s looming options expiry could spark a bout of price volatility, with previous large expiries causing the market to “bounce quite aggressively” and the size of the bitcoin open interest market recently soaring.

Bitcoin open interest has climbed to $1.3 billion, double what it was just a couple of months ago, according to data from bitcoin and crypto analytics provider Skew.

Deribit, a Panama-based derivatives exchange, accounts for 77% of the bitcoin options market, although regulated venues CME and LedgerX have gained ground recently.

The split between bullish and bearish options is currently fairly neutral, although most of the CME contracts are for bitcoin at above its current price—with 75% of CME contracts calling bitcoin at $11,000 and higher.

On top of Friday’s coming bitcoin options expiry, global stocks have slipped due to a resurgence in coronavirus infections across Europe, the U.S. and China weighing on investor confidence.

“The key thing to watch over the next few weeks is the Covid-19 related equities sell off,” Chris Thomas, head of digital assets at Swissquote Bank, told Coindesk.

“If markets react very negatively towards the increased Covid-19 cases, we may see more panic which could also pull bitcoin lower.”

There are far more bitcoin options set to expire this week than usual–something that could trigger … [+]

Meanwhile, despite a surge in bitcoin options interest, most bitcoin buyers are treating it as digital gold, preferring to hold bitcoin for the long term term.

“The data shows that the majority of bitcoin is held by those who treat it as digital gold: an asset to be held for the long term,” Chainalysis researchers wrote last week.

“With more people looking to trade bitcoin, which is only becoming more scarce following the recent halving, bitcoin moving from the investment bucket into the trading bucket could become a crucial source of liquidity. However, one would expect this will only happen if bitcoin’s price rises to a level at which long-term investors are willing to sell.”

No Comments

Leave a comment Cancel