Get Forbes’ top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

(Photo by S3studio/Getty Images)

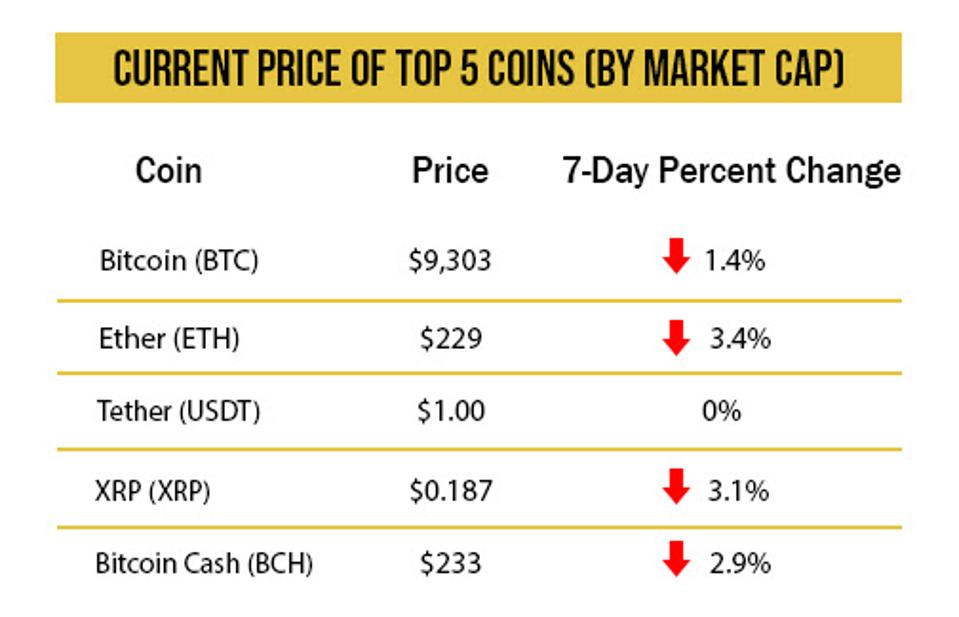

CRYPTO MARKETS

Bitcoin dipped below $9,000 for the first time in June early Monday morning, though it quickly rebounded for a relatively calm week. Unfazed by its stagnant price movements, some high-profile investors like Chris Burniske still see bitcoin breaching $50,000 during its next bull run, anticipating that it will account for a significant portion of gold’s market share.

A Chainalysis report found that 85% of the bitcoin currently held on exchanges is in the hands of professional traders who rarely make transfers. In fact, 96% of all transactions are made by retail investors who control a much smaller slice of the overall pie. The last time the level of long-term “HODLing” rose this high was just prior to its meteoric 2017 rise.

Source: Messari. Prices as of 4:00 p.m. on June 19, 2020.

TRUMP’S MISTRUST

Bombshell excerpts from former National Security Advisor John Bolton’s book about his time in the Trump White House dominated the national news this week, and he even included a reference to bitcoin. Bolton wrote that in 2018—long before Trump made his bitcoin skepticism public in a series of tweets last year—the president privately urged Treasury Secretary Steven Mnuchin to “go after bitcoin” in a conversation about trade sanctions on China, believing it to be a vehicle for fraud.

REGULATION

Chris Giancarlo, former chairman of the Commodity Futures Trading Commission who was nicknamed “Crypto Dad” after crediting bitcoin for getting his kids interested in finance, co-authored an opinion piece arguing that XRP should not be regulated as a security, but instead as “a currency or a medium of exchange.”

When Giancarlo was in office from 2017-19, he helped establish the criteria that led to bitcoin and ether being declared commodities instead of securities. In his point-by-point rebuttal of the SEC’s Howey Test for securities as it relates to XRP, he thinks the world’s fourth-largest cryptocurrency should receive similar treatment. If only he was still in a position of regulatory authority to take action on it.

ENTERPRISE

Apple’s App Store and Google Play both approved and admitted an app built on the Ethereum blockchain that allows employees to prove the results of their Covid-19 tests and, eventually, whether or not they have been vaccinated if one gets developed. Civic Technologies hopes its blockchain-based app will ease some citizens’ concerns about data privacy in contact tracing.

Plus, crypto-friendly lender Silvergate is making it easy to borrow against bitcoin with a partnership with San Francisco-based custodian Anchorage. The Federal Reserve member bank will now offer crypto-backed loans to customers while still allowing the digital assets to stay secure in Anchorage’s custody.

IS BITCOIN LIKE OIL?

Bitcoin has long been described by proponents as digital gold, but its trajectory has also shared some similarities with another cornerstone asset: crude oil. Nobody quite knew what to do with oil in the late 1800s as a cumbersome commodity with limited real-world uses, good for kerosene lamps and not much else.

Bitcoin’s original proposed use case as a possible fiat alternative appears to have been a failure, but its shortcomings have spurred innovations in other areas that offer hope for an unknown killer app on the horizon, just like cars and planes eventually sparked consistent demand for oil.

ELSEWHERE

Agents of Influence: He Who Controls The Blockchain, Controls The Cryptoverse [Cointelegraph]

Wall Street Greets WisdomTree’s Bitcoin ETF Plan With Doubt [Bloomberg]

‘Snake Oil and Overpriced Junk:’ Why Blockchain Doesn’t Fix Online Voting [CoinDesk]

No Comments

Leave a comment Cancel